Getting coffee from a classy café and strolling down the street before going to work is a routine that many working professionals frequently portray in films across the globe. As their reality appears to be distant from this cinematic world, many in real life eventually end up only dreaming of it.

Just a few days after the pay cheque arrives, the momentary happiness quickly turns into a reflection of life’s costs, leaving one feeling stretched financially. These costs range from paying for necessities like groceries, electricity, rent, and transportation to enjoying a fancy morning coffee or weekend café hopping.

Jamshedpur-born Shubham Srivatsa, 27, employed for over four years now, also associates his initial working days with freedom and enjoyment. “When I moved to Pune for my first job, I focused more on the activities which provided momentary fun. I looked forward to going to a café, movies, or buying new shoes,” he says. He did not think about saving money early on and did not know where and how to invest his money.

While many are drawn to the allure of ‘momentary fun,’ adopting a proactive approach like Srivatsa did, by cultivating the habit of saving early, is a wiser choice, advise financial experts. With freedom comes responsibility and many struggle to manage it, especially, when climbing the initial steps of the income ladder.

Happiest Health speaks with multiple financial educators to understand commonly made mistakes by citizens suggesting ways to reduce the financial stress. Manish Chauhan, founder of Jagoinvestor.com, a financial planning website educating people about the nuances of improving their financial life, says that the positive attitude of “I will start saving in a few years once my salary increases,” is not logical and a mistake commonly made by most people. “Life is dynamic and unpredictable; hence, you cannot foresee an emergency expense and will struggle to handle it,” he adds.

The only incentive driving employees to work daily is the salary that is credited at the end of each month. “I wake up every morning with zero motivation to work, I am just doing this job for the money,” is a commonly heard phrase now.

Financial stress and health

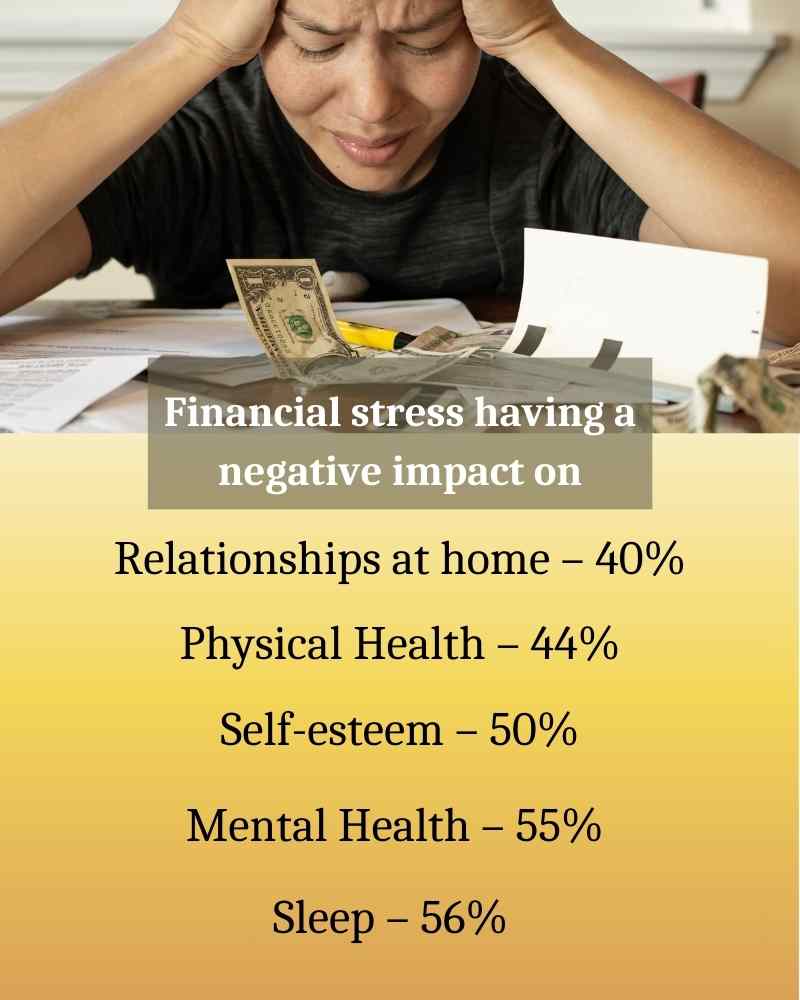

In 2023, the professional services network PwC unveiled its insightful Employee Financial Wellness Survey. The findings painted a telling picture: a staggering 60 per cent of full-time employees cited financial concerns as their primary source of stress, a figure that slightly surpasses the levels recorded during the peak of the pandemic. The data further revealed that 59 per cent of the workforce is grappling with the escalating cost of living, struggling to maintain their financial equilibrium amid soaring expenses.

Financial wellness educator, Danetha Doe, founder of a US-based financial education company, Money and Mimosas, points out, “Financial stress has a widespread impact on an employee’s productivity and overall emotional well-being.” She references a compelling study by the Financial Health Network for Morgan Stanley, which revealed that among employees experiencing high financial stress, a significant 78 per cent acknowledge that this anxiety hampers their work productivity.

Empowering financial wellness: a solution for stress reduction

Financial wellness means feeling sure and clear about how money affects your life. Manisha Thakor, the founder of MoneyZen, a US-based financial wellbeing consultancy, emphasises the distinction between mere financial wealth and true financial wellness. She notes, “These days, there is so much pressure to ‘earn more, make more, buy more, be more’ that it can be easy to mistake financial ‘wealth’ with financial ‘wellness.’”

Financial wellness and financial well-being are often used interchangeably, says Doe. “But they do have a slight distinction. The former denotes action steps, while the latter denotes an emotional state.”

Thakor clarifies that true financial wellness empowers you to optimise your life choices and happiness, utilising the financial resources you have at present. This means that financial wellness transcends income levels. It is not about the amount of money you earn, but how effectively you manage and align your finances with your life’s goals and values that matter.

How to achieve financial wellness?

“Achieving financial wellness is a multi-step process, it involves identifying your needs and desires, creating a financial action plan to address them, and following through on the plan,” says Doe.

Starting to save early is a surefire method to get started on the path to securing one’s financial health. Chauhan, meanwhile, emphasises that people need to begin saving as soon as they begin to earn. While it may seem like a little sum, saving between Rs 5,000 and Rs 10,000 each month might help develop a habit that will pay off later in life. Due to their lack of saving during their prime years and inability to anticipate potential future needs, many people in their 40s struggle to manage funds for their entire family. People should avoid spending under peer pressure or on unnecessary avenues.

Over the years, Srivatsa has also improved her financial management skills and reached a state free from ongoing worry over time. “Though my expenses are on the higher end now, I try and invest my money and pay all the compulsory expenses within the first 1-2 days of receiving the salary. It gives me a better understanding of my expenses and keeps me from overspending on unnecessary things.”

To cultivate mindful spending habits early on, even while enjoying occasional indulgences like a delightful cup of coffee, Thakor introduces the concept of ‘joy-based spending.’ She describes it as a strategic approach to managing finances from your first pay cheque. It involves carefully balancing your expenditures to enhance your happiness both in the present and future, ensuring each dollar spent contributes to your overall contentment.